estate tax law proposals 2021

If the exemption is decreased from 117 million to 35 million and the estate tax rate is raised from 40 percent to 45 percent the cost of inaction is nearly 37 million if an individual makes a gift of 117. However on October 28 and then again on November 3 the House Rules Committee.

Biden S Budget Proposes Tax Hike On Married Filers Over 450 000

And while the gift and estate tax exemption is scheduled to drop to approximately one-half the current amount on January 1 2026 there also are tax proposals in play that could change the estate and gift tax laws much sooner.

. Ad Helps track assets debts expenses distributions and more. Plan for and administer retirement accounts in a trust or estate. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction of the Federal Estate Tax Exemption.

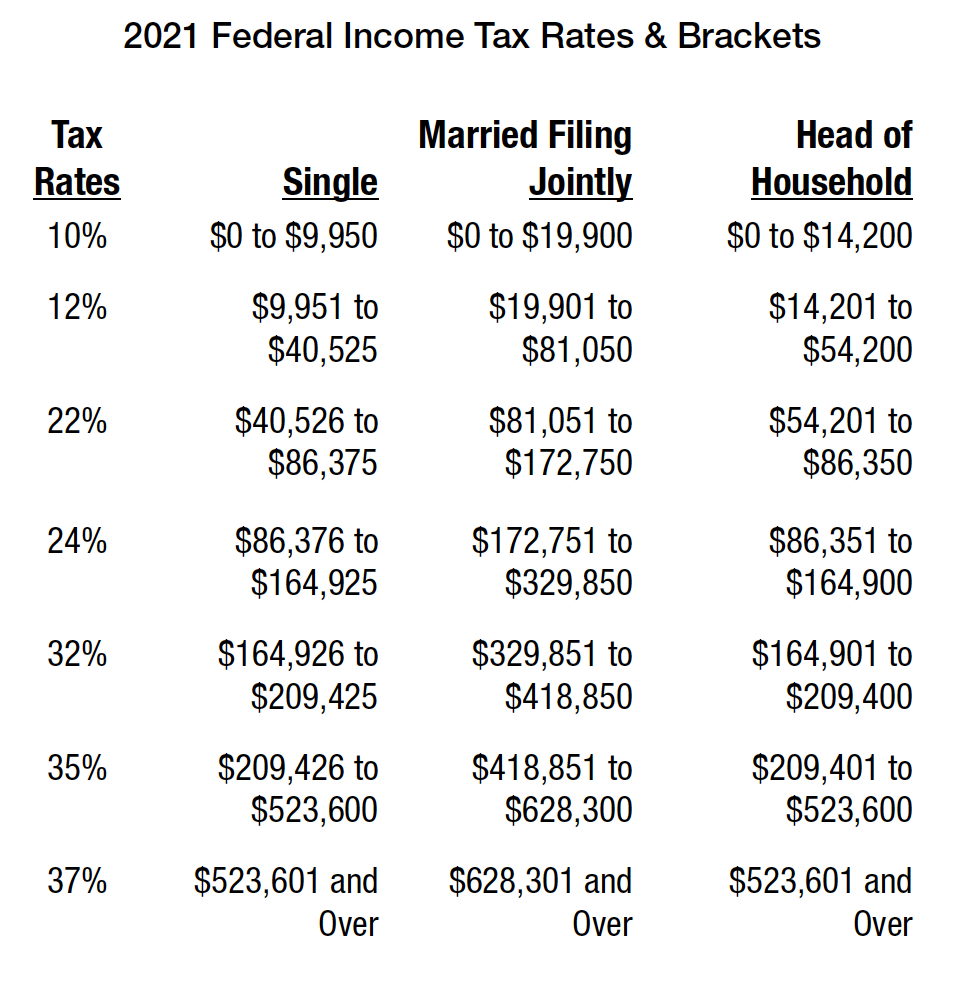

The top income tax rate of 37 and the top tax rate of 20 on investment income was not raised except for those subject to the surtaxes. Reduction in Federal Estate and Gift Tax Exemption Amounts. 2021 Federal Estate and Transfer Tax Law Proposals.

Under current law the existing 10 million exemption would revert back to the 5 million exemption. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year. The House proposal accelerates the 2026 reduction to 2022 and.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

However the proposal was nixed from Bidens tax plan. Note the tension in current year planning if this proposal is adopted. For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the federal exclusion amount.

In New York estate tax is imposed on gross estates with a value of more than 593M in 2021 and 611M in 2022. Tax rates for C corporations were not raised. T11-0156 - Baseline Estate Tax Returns.

If your estate is higher than the basic exclusion. What are the proposals. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year.

Get an Estate Planning Checklist More to Get the Information You Need. Current Law in 2021. Under current law the exemption is 750000 in fair market value for farmland but the exemption also is indexed for inflation which bumps the current exemption up closer to 119 million.

The Effect of the 2017 Trump Tax Cuts. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117 million per person for 2021. 593M as of 2021 and 611M as of 2022 are called the basic exclusion amounts.

That is only four years away and Congress could still. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation. Ad Information You and Your Lawyer Could Use for a Solid Estate Plan.

The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. An annual exclusion of 15000 per doneeper year is. None of the items included in this proposal would be retroactive to earlier in 2021.

Again World War I created an urgent need for more government revenue. Proposed effective date is retroactive to January 2021. If your estate falls below the basic exclusion amount your estate is not subject to estate tax.

All items would be effective after December 31 2021. Potential Estate Tax Law Changes To Watch in 2021. Try it for free.

If the exemption is. California Specialization Credit in Taxation. 2021-2022 Federal Estate Tax Rates.

The current estate gift and generation-skipping transfer GST tax exemption is 117 million per person with a top tax rate of 40 which is set to sunset at the end of 2025 to pre-2018 levels to approximately 6 million 56 million adjusted for inflation. The proposal in Congress would cut the federal exemption in half. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

What we now think of as federal estate taxes became law in 1916. As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. On the campaign trail then-candidate Biden expressed a desire to reduce the gift and estate.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Fisher Investments has 40 years of helping thousands of investors and their families. California Specialization Credit in Estate Planning Trust and Probate.

18 0 base tax 18 on taxable amount. If passed both the federal and New York estate tax exemptions for 2022 would be about 6 million. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Payment of the capital gains tax would secure the step up in basis at death. Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples. Pacific Time - Intermission.

Current Law and Multiple Reform Proposals 2011-2021. Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples. It includes federal estate tax rate increases to.

Discussing proposals because they rarely become law in the form they are proposed these proposals are worth discussing and understanding the implication. November 16 2021 by admin. The Sanders proposal had provided for a 1 million gift tax exemption and a 35 million exemption for estate and GST tax purposes.

For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the.

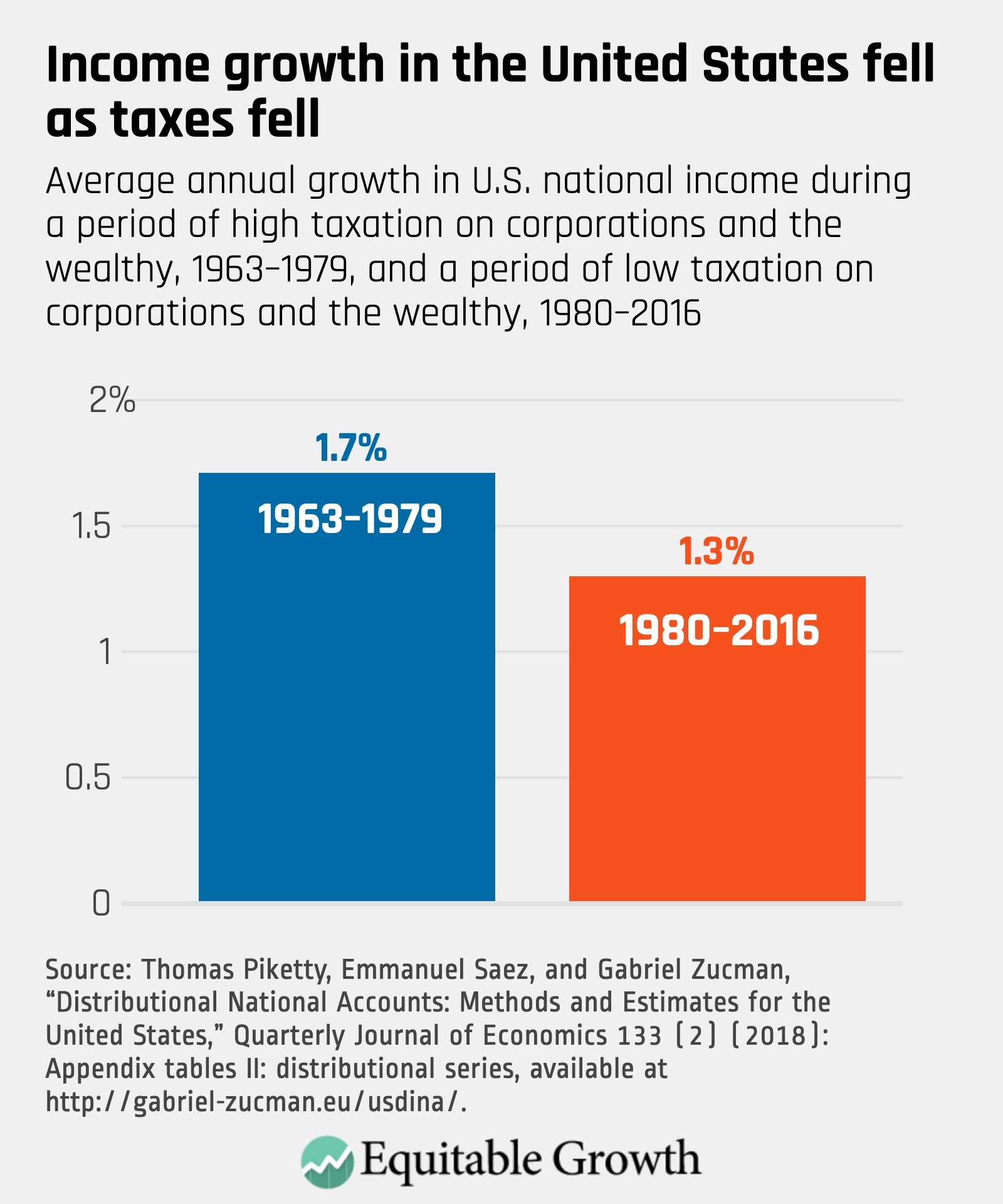

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Secured Property Taxes Treasurer Tax Collector

State Corporate Income Tax Rates And Brackets Tax Foundation

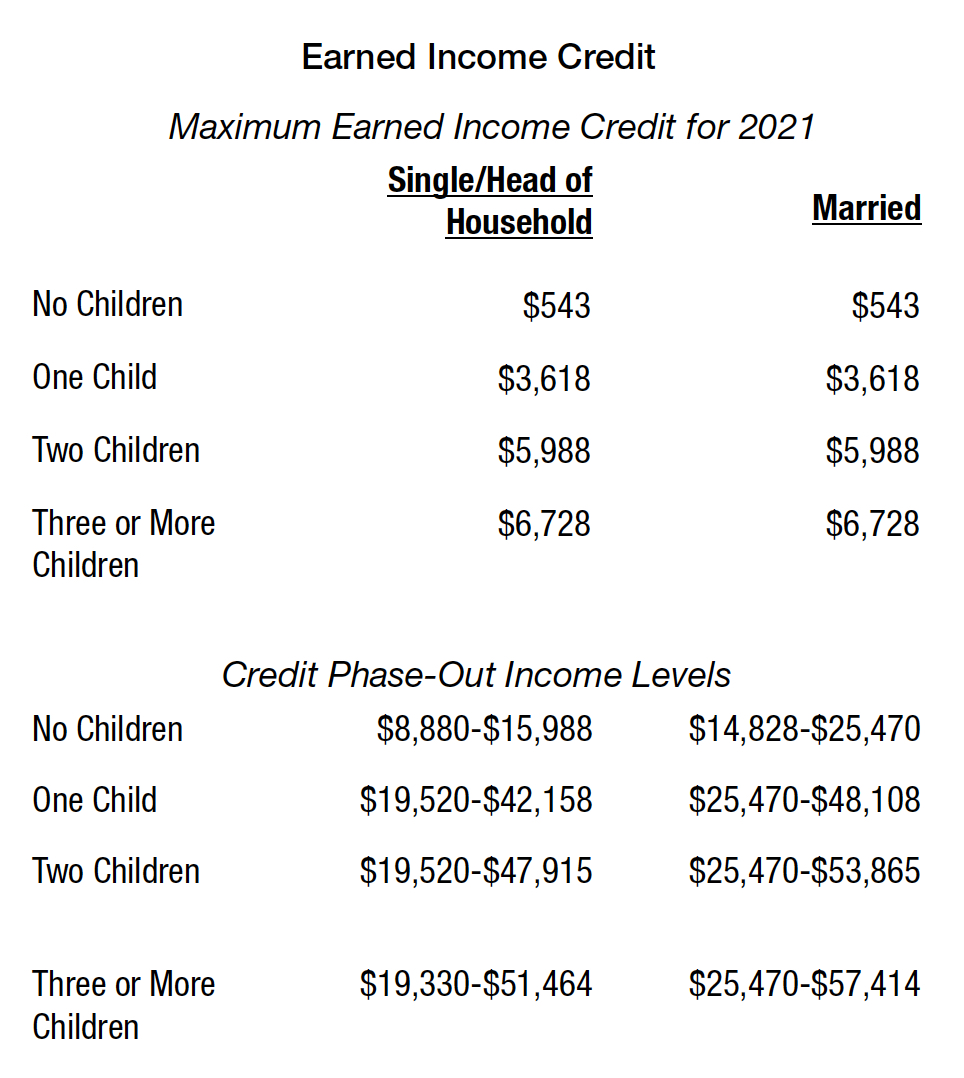

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Corporate Partnership Estate And Gift Taxation 2021 1st Edition Pratt Solutions Manual Pratt Corporate Solutions

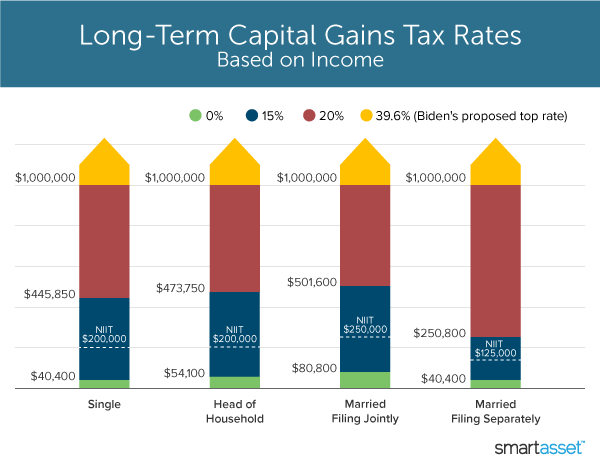

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Internet Sales Taxes Tax Foundation

Managed Service Provider Proposal Template

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

How Do State Estate And Inheritance Taxes Work Tax Policy Center

It May Be Time To Start Worrying About The Estate Tax The New York Times

What S In Biden S Capital Gains Tax Plan Smartasset

It May Be Time To Start Worrying About The Estate Tax The New York Times

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

House Democrats Tax On Corporate Income Third Highest In Oecd

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

New York State Enacts Tax Increases In Budget Grant Thornton